For those concerned that this economic expansion is getting too long in the tooth, consider that we have in many ways just exited a mini-recession.

The rapid appreciation of the U.S. dollar starting in the summer of 2014, coupled with the plunge in energy prices, resulted in a severe contraction in commodity, export and manufacturing businesses. Credit conditions tightened significantly, and marginal producers dependent on debt financing either retrenched or failed. In fact, U.S. companies experienced declining earnings for five consecutive quarters ending in the third quarter of 2016.

The nuance of whether we’ve had a recession or whether we are continuing the existing expansion isn’t important. There has been a re-set of the investment landscape, and asset classes and sectors which typically perform well early in the cycle are outperforming and will likely continue to do so in the upcoming year.

Global Uptick

We don’t think we are in a “Trump Bubble.” Recent months have revealed stronger economic data as well as improved confidence numbers, and this upturn preceded the U.S. election. The United States is not alone in its recent improved economic pace. The growth momentum has picked up in many advanced and major emerging economies (Chart 1).

Despite Europe’s ongoing challenges, most European countries are showing improvement. For example, in December the German business climate index hit its highest level in almost five years. China has also shown better numbers and non-Chinese companies that sell into China are verifying the official stronger data. As confirmation of this global strength, industrial metals, oil, and other economically sensitive commodities have rebounded significantly. Commodity strength has benefited resource-dependent economies such as Russia, Brazil, Canada and Australia. Given the prior large price declines, the recent rebound in commodities hasn’t reached the levels where they constrain consumers; for example, oil is still 50% below its price in mid-2014 despite doubling from its lowest levels.

Stock market sectors most sensitive to economic growth, such as energy and financial stocks, were outperforming the overall market prior to early November. As noted in Lyell’s “Election Edition” Perspective, the fundamental and technical data have supported a pro-cyclical investment stance rather than a defensive one. For that reason we are pleased that the shift in investor sentiment since the surprise election of Donald Trump has led to only a very small change to our investment strategy. We view our client portfolios to be well positioned for the current environment.

Election Impact

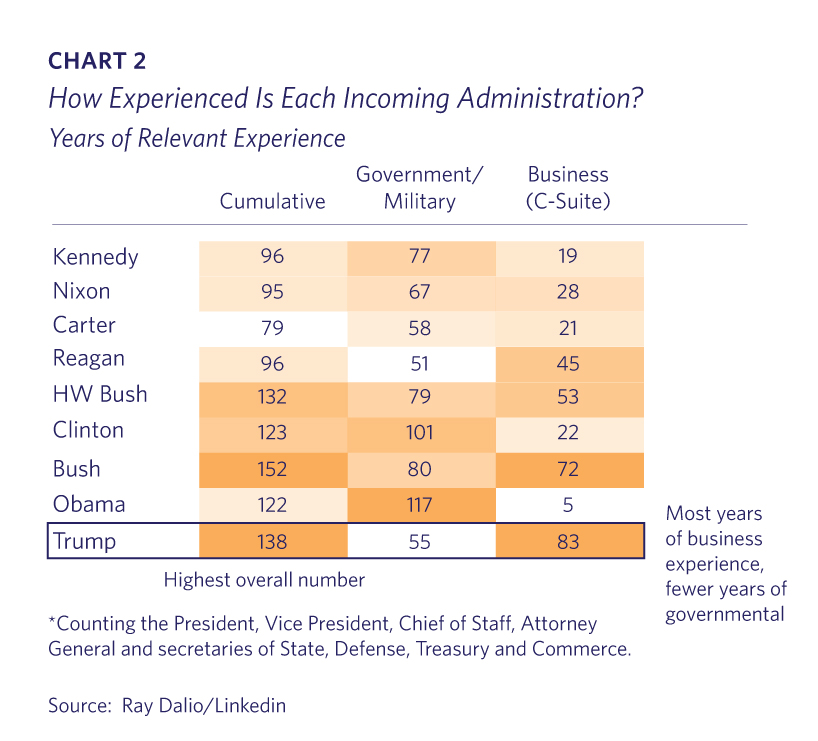

Donald Trump’s election has been a bitter pill to swallow for many Americans, and there is little doubt that the Trump administration will have different priorities than President Obama’s. One may disagree with his agenda, and it is entirely possible that these changes will eventually result in major problems fiscally, economically or environmentally. Presidentelect Trump’s platform is more narrowly focused on economic development, growth and jobs; not surprisingly his nominees are heavily tilted towards commerce, and they collectively have more business experience than each of the previous eight administrations (Chart 2). Activity in the energy sector is likely to broaden as Trump’s appointees approve projects. It appears that some of the restrictions placed on banks by Dodd-Frank will be loosened and will be overseen by regulators more sympathetic to revenues versus compliance.

While the President-elect has been the primary media focus, an equally important element of the election is the Republican control of both Houses of Congress. Most investors assumed that our government would remain divided and therefore largely grid-locked. With the Republicans in charge of both Congress and the White House, there is a belief that sweeping tax reform will be enacted. On the agenda are lowering the corporate tax rate, simplifying the individual tax code, and a “repatriation holiday,” in which corporations that hold money overseas would be allowed to return it to the U.S. for a discounted tax bill. There are still many details to work through, and deficit hawks in the Republican Party are likely to fight legislation that increases the debt. These reforms, should they pass, would be positive for the economy and for markets.

Regardless of any personal feelings about the election outcome, Lyell sees an increased likelihood of “animal spirits” appearing, which have been missing in this economy for many years.

The U.S. Economy – A Coiled Spring?

The U.S. economy has been growing steadily, if weakly, throughout this expansion, but it has yet to “take off.” This has resulted in the unusual combination of a tight labor market with unemployment at 4.6%, but subdued wage growth and inflation. Interest rates have stayed low. And, until recently, corporate and consumer confidence has remained weak. However, it appears that, even before the election, we may have hit an inflection point.

GDP for the third quarter was revised up to 3.5% which is substantially above the 2% trend line for this expansion. Labor markets remain strong, with initial claims for unemployment incredibly low relative to the size of the population (Chart 3). The Bureau of Labor Statistics’ Job Openings and Labor Turnover Survey continues to trend upward in employee “quits”, indicating workers’ confidence to resign. Wages have accelerated from roughly 2.5% annual growth to 3.9% over the last year (Chart 4).

Notably, in December the Economic Cycle Research Institute (ECRI) weekly index hit the highest level in a decade, which is a marked step-up from prior levels in this cycle (Chart 5).

U.S. consumers are not overleveraged like they were prior to the Financial Crisis with household net worth hitting a record $90 trillion according to Barron’s. The household financial obligation ratio (% of U.S. consumers are not overleveraged like they were prior to the Financial Crisis with household net worth hitting a record $90 trillion according to Barron’s. The household financial obligation ratio (% of budget that consumers must dedicate to service debt) has stayed around 15.5% since plummeting from over 18% a decade ago (Chart 6). These low levels were last seen in the early 1980s.

Confidence – The Missing Ingredient?

Rising wages, with low unemployment, inflation, interest rates, and consumer debt levels – that is a lot of kindling. So why hasn’t the economy been on fire? Perhaps it is just a lack of confidence.

James Paulsen from Wells Fargo Capital Management was recently highlighted by Barron’s citing the potential for consumer “confidence spending.” Spending on items such as consumer durable goods, housing, and business investment requires conviction about the future. Paulsen calculates that such confidence spending as a percentage of nominal GDP remains in the bottom 20% of its history. Such a low level creates the potential for a substantial increase in consumer spending if confidence improves.

Business confidence has also been muted throughout this economic cycle. Public companies have been more focused on stock buybacks and financial engineering than new capital expenditures. However, the National Federation of Independent Businesses (NFIB), a leading small business group, saw a major jump in expected business conditions and hiring plans in their December survey. Business inventories have declined dramatically over the last five quarters. The last five times inventory accumulation has slowed this significantly, GDP growth has accelerated over the subsequent year by an average of 4.3%.

Consumer and business confidence peaked in early 2015 and then trended lower until mid-2016. After the Brexit episode, both series began to move higher again and have accelerated further since the election, with consumer confidence hitting its highest level in the last 15 years. The New York Times ran a headline in early December saying “Confidence in the Economy is Booming.” Perhaps this is the spark we need to generate an economic reacceleration.

U.S. Stocks

The postelection rally has added 6% or $1.5 trillion to the value of U.S. equities since the market’s close on Election Day. It continues to be a good environment to invest in the right U.S. stocks. Economic growth is accelerating and, although interest rates are rising, they remain very low relative to history. Valuations are not low, but if earnings accelerate as we expect, they will look reasonable in retrospect. The inflation “sweet spot” for P/E multiples is in the 0-4% range, so the modest climb in inflation doesn’t pose a near-term risk to valuations. In addition, the stock market typically peaks late in the Federal Reserve interest rate tightening cycle, not at the beginning.

Sector performance in a rising rate environment should favor Financials, Industrials, Technology, Energy and Materials companies over Utilities, Telecom, Consumer Staples and Health Care stocks. This trend of relative outperformance started in September prior to the election and has accelerated since then. We see the small capitalization stock universe as likely to benefit in the upcoming year; the combination of easier credit, domestic orientation and increased economic activity should re-establish the premium valuation that they have typically enjoyed over large-cap stocks. During December the number of small-cap stocks trading at their 52-week high hit the highest reading in the last twenty years.

Bifurcated Market

It is typical that small-cap and cyclical stocks outperform defensive stocks when the yield curve steepens (the difference between long and short-term interest rates increases), which is currently occurring; conversely, defensive sectors outperform during curve flattening. Unsurprisingly then, there has been continued pressure on bond proxies, such as Utility and Consumer Staples stocks. We see more pain ahead for these sectors as yield-starved investors previously overpaid for their relatively high dividends. Fortunately Lyell owned no Utility stocks and has minimal Consumer Staples exposure.

Two other sectors deserve comment. Healthcare stocks have been under pressure for months due to concerns over drug pricing and political changes that may impact pricing in the future. There was a major bounce in Pharma and Biotech stocks post-election as it was perceived that these concerns would disappear with a Republican administration. There is a growing realization that drug pricing has become a bi-partisan issue. This sector will likely replace the banks as Washington’s favorite political target.

Though some investment sectors have narratives that make price changes understandable, the reasons for the relative weakness seen in technology stocks aren’t as obvious. Some experts surmise that investors have used these stocks as a source of funds to deploy into the financial and energy sectors. Other theories include concern over the Trump administration’s unknown policy toward H1-B visas, global supply chains being negatively affected by potential China trade friction, possibly political payback for Clinton support, and rising interest rates conceivably decreasing the appropriate multiple on nondividend paying stocks. Lyell’s view is that many of the fastest growing, best positioned companies are in this sector and that investors should not reduce exposure.

Market Technicals

In addition to the stronger fundamental underpinnings, the market’s technical picture looks favorable on virtually all measures. There are key differences today versus in 2013 when stocks dropped as interest rates rose in the “Taper Tantrum.” Critically, high yield or “junk bond” spreads have continued to tighten, signaling economic strength and ample market liquidity; the importance of this difference cannot be overstated. Further, rather than a narrowing market in which a few stocks carry an index higher, market breadth is strong. The equal-weighted stock index is outperforming the market-weighted one; sustainable market moves are typically characterized by a large percentage of stocks participating in the advance. Lastly, the most common measure of volatility, the VIX, which spiked 16% in 2013, has been dropping and down over 30% in recent months.

Repatriation

One near certainty in the upcoming year will be a repatriation of cash held overseas by U.S. businesses. The timing isn’t clear as comprehensive tax reform takes longer than just reducing rates, but sometime in 2017 we should see a repatriation. There is over $2.5 trillion held overseas currently. The last U.S. repatriation holiday was passed in October 2004 and over half of the $600 billion in overseas cash was repatriated. While the direct impact on investment is difficult to measure, both stocks and the US$ increased over the following year.

Risks

Although many of the market factors that we monitor look positive, there are always risks. The market is currently pricing in a lot of good news, and expectations for our new government are high. Should the Republicans stall and prove unable to deliver tangible progress on regulations and taxes, the market is likely to retrace much of its recent move. Trump’s unique communication style and unpredictability makes it almost a certainty that we will experience market volatility from time to time. For these reasons, although Lyell remains optimistic about the market’s direction, we continue to focus on balanced, diversified portfolios.

Europe

We are witnessing the slow dissolution of the European Union (EU), as populism broadly gains influence. Great Britain had its “Brexit” in mid-2016, and in December Italy overwhelmingly rejected a referendum sponsored by its popular Prime Minister. In most national and local elections across the Continent, farright and far-left parties are gaining versus the establishment parties. We think stocks in Europe are cheap and deserve to be. The market yields for bonds issued by Italy, Spain and other peripheral countries don’t compensate for the risk. Most of the region’s banks have poor business models and are effectively nationalized due to their under-capitalization. Although our markets handled Brexit and the recent Italian referendum well, Europe will likely be a source of periodic surprises and market turmoil. Lyell does not have any direct investments in Europe.

China

China has provided unsustainable fiscal support to its economy as it prioritizes stability over reform. This is helping in the short term, as nominal GDP likely increased from 6% in 2015 to over 8% in the most recent quarter. However, we remain wary of the long-term consequences of their actions.

The Western financial media has made much of China’s currency and declining foreign reserves. Similar to Singapore’s longstanding practice, China started pegging its currency to a basket of currencies in August 2015, not just to the US$. While the Yuan has been dropping in value versus the US$, it has been holding steady against the new basket which incorporates euros and yen. The media has reported that the decline in China’s now $3 trillion in foreign reserves has been caused exclusively by capital flight which, if true, could suggest a worrying decline in confidence. However, the reality is that several factors are at play, of which capital flight is only one element. Of November’s $69 billion decrease, two-thirds was explained by a drop in the euro and yen versus the US$. The Chinese government is concerned about managing its currency in an orderly manner and is more closely monitoring overseas transactions. The surging US$ is making a manageable depreciation versus the US$ challenging. While Lyell does not presently view China’s currency or foreign reserves as a threat to the global markets, it is very likely to receive heightened media scrutiny.

Trump Again

Very possibly the most important unknown with the Trump administration is how it interacts with China. The economic interconnectedness between China and America is deep (“Chimerica” as coined by Niall Ferguson). Thus far the markets have shrugged off Trump’s tweets and comments as theater versus policy. The importance to the global economy and markets of the Chimerica relationship, however, could result in turmoil related to his posturing. Sophisticated “China hands” have assured Lyell that China understands very well the difference between domestic posturing versus real policy. We think that there is too much at stake for China and the U.S. to let its relationship seriously deteriorate.

Emerging Markets

Periods of rising US$ interest rates and currency strength have at times been associated with turmoil in the emerging world as their markets lose liquidity and credit access. Emerging market borrowers have accumulated over $3 trillion in US$ debt according to the Bank for International Settlements. This debt becomes more expensive to service as their currencies depreciate versus the US$. Along with Europe’s political evolution and EU fragmentation, emerging market debt is one of the more visible sources for potential global market volatility. However, aside from losses for investors in emerging market bond funds, any crisis is unlikely to pose a longer term challenge to the U.S. and its markets. Lyell would view any financial contagion emanating from the emerging markets as akin to the “Tequila Crisis” in 1994 or the “Russian Flu” in 1998 that ultimately provided good buying opportunities rather than causing a global downturn.

An underreported recent development in India is worth noting. On November 8, 2016, the country woke up to find that all rupees in denominations larger than the equivalent of US$7.50 would no longer be accepted as legal tender as of year-end. Anyone with physical currency in these larger denominations was required to deposit their rupees into the banking system up to a limit of $3,700; amounts in excess of $3,700 required proof that taxes have been paid on this wealth previously. This massive exchange would be a difficult task to execute in a country with a sophisticated banking system and where most savings are held in the financial system. However, in India where an estimated 90% of commerce is cash based, up to 50% of the economy is “off the books” and institutional mistrust is cultural, this act will inevitably have many unforeseen consequences. Prime Minister Modi’s stated intentions were to shrink the black economy, root out terrorists and counterfeiters and expand the paltry tax base (just 5% of Indians pay income tax). However, the immediate result of this cash crisis has been chaos. The long term results may be favorable to jolt India into a modern-age financial system, but the short-term effects have included economic uncertainty, slower growth and volatile markets.

Fixed Income

It looks like the 35-year bull market in bonds is over. Budget austerity is going out of fashion globally, as populist movements result in greater fiscal stimulus and higher deficit financing; this fiscal stimulus is assuredly reflationary, if not inflationary. Over $1.5 trillion in market value has been lost in the last month as bond prices have dropped. We are at the end of the road for risk-free returns, as U.S. Treasury returns have been less than 1% in each of the past two years.

Getting Positive

Global Central Bank bond buying via “quantitative easing” has removed $17 trillion of bonds off the market, but it appears the central banks have realized that negative interest rates were a policy error. In July 2016 there were approximately $13 trillion in sovereign bonds with negative yields. While some deposit rates in Europe and Japan are still negative, all 10-year government bond yields with the exception of Switzerland have moved into positive territory. Negative bond yields were an existential threat to the markets and posed unknown risks to the banking and financial systems; any movement into positive territory should be applauded.

Credit Spreads

The U.S. 10-year Treasury yield hit a low of 1.35% in July 2016 versus 2.45% today; while it may only be a 1.10% difference, it represents almost a doubling in yield. As referenced earlier, a very important sign with this backup in yields has been that credit spreads have not widened; spreads are at their lowest levels in the past two years even as rates have moved up. Spreads staying tight to the Treasury curve, particularly for High Yield bonds, indicates that rates are rising due to expectations of better economic growth (Chart 7). It is also suggestive of a continued good environment for risk assets, such as stocks. The Bespoke Report has noted that these credit conditions typically exist early or mid-economic cycle in stock bull markets which provides further confirmation of Lyell’s view that this cycle will be elongated.

Lyell has focused its clients’ bond portfolios on shorter maturities. As a result, we are not being penalized by rising rates and will be able to rollover into higher yields as bonds mature. Although we see rates moving higher, there are multiple factors such as slow global growth and productivity, aging demographics, and over-indebtedness, which should limit interest rate increases. Global linkages incorporating currency levels enable arbitragers to maintain a relationship between different markets. As interest rates diverge, such as the 2.5% difference between U.S. and Japanese 10-year bonds, investors can hedge their currency exposure and pickup the higher yield. For this reason, the U.S. can only become unmoored from the global rate regime to a certain extent. In addition, with so much cross-border capital and trade flows, the U.S. can only increase rates to a point before US$ currency appreciation slows the economy.

Gold

Slow economic growth and central bank activism that included negative interest rates made gold a reasonable diversifier and hedge. There was minimal opportunity cost having a small part of a portfolio allocated to gold. However, the populist movements most recently culminating with Trump’s election have changed the equation. With interest rates heading north and the opportunity cost to own gold increasing, Lyell liquidated its small position in gold quickly after the November election and re-allocated to U.S. stocks.

The U.S. Dollar

There is legitimate concern about the increase in the value of the US$ on a trade-weighted basis. Since the U.S. election, the US$ has surged to a 14-year high and is up approximately 10% versus the euro and yen, and even more so against some emerging market currencies. This strength is reflective of the U.S.’ relatively higher economic growth, inflation and interest rates; as confirmation, the European Central Bank released data on December 20, 2016, noting that the Eurozone had its largest ever net outflows in the 12 months to September. It appears that US$ strength will be a continued theme for the foreseeable future, and that there will likely be some turbulence as various countries, markets and companies adjust. However, the U.S. is still a relatively domestically oriented economy. It is also worth noting that the U.S. economy and stock market can perform well during US$ strength, such as during the 1990s; even during the 1980s’ dollar weakening phase the absolute currency level was stronger than today’s exchange rates (Chart 8).

Takeaways

The global economic picture has improved and looks set to continue to strengthen throughout 2017. Populism in the U.S. and Europe will lead to increased government deficit spending, and central banks will continue to be very accommodative. The battle between inflation and deflation is shifting in favor of inflation. If the Trump administration proves pragmatic, the U.S. could see a return of “animal spirits” which should provide a virtuous cycle of greater risk taking and growth.

However, Lyell’s core investment philosophy hasn’t changed. Principles such as diversification and liquidity are the same. Prior to the recent economic uptick and election, we had already geared equity portfolios towards the more cyclical sectors of the economy; we thought they were more attractively valued as the defensive sectors were overpriced. However, our overall asset allocation continues to emphasize a balanced approach, as we know that volatility can appear at any time.